Submitting clean medical claims is crucial to keep your revenue cycle flowing and payments on time. Even minor claim errors can lead to severe delays or lost revenue. But not all claim issues are alike. Knowing whether it’s a claim denial or a claim rejection helps billing teams take the right corrective actions.

In this ultimate guide, we’ll explain the difference between claim denial vs claim rejection, outline their common causes, and share expert strategies to minimise errors and maintain a healthy cash flow.

What Is a Claim Rejection?

A claim rejection occurs when a claim fails to pass the initial validation checks by the payer or clearinghouse due to data, format, or eligibility errors. Simply put, it’s never accepted for review.

Common causes include:

- Incorrect patient or provider details

- Invalid CPT or ICD-10 codes

- Missing or mismatched insurance information

- Formatting or submission errors

Rejected claims are easier to fix. Once the error is corrected, the claim can be resubmitted for processing.

What Is a Claim Denial?

A claim denial happens after the payer reviews the claim but decides not to pay. This means the claim passed the first stage but failed the payer’s internal rules or policies.

Common reasons for claim denials include:

- Lack of medical necessity

- Missing prior authorisation

- Non-covered services under the patient’s plan

- Documentation or compliance issues

Each denied claim includes a denial code that identifies why payment was refused. Tracking and analysing these codes helps identify patterns, correct root causes, and prevent future denials.

Claim Rejection vs Denial – Key Differences

Understanding the distinction between claim rejection vs denial is essential for maintaining an efficient revenue cycle. While both terms relate to payment delays, they occur at different stages of the billing process and require different corrective actions.

| Aspect | Claim Rejection | Claim Denial |

| Stage of Occurrence | Before payer review (not accepted). | After review (accepted but not paid). |

| Primary Cause | Technical or data-entry errors. | Policy or medical necessity issues. |

| Correction Process | Simple resubmission after fixing the data. | Requires appeal and supporting documents. |

| Impact on Revenue | Minor delay, quickly fixable. | Significant delay affects revenue and workload. |

In short, Rejections are technical errors that block claim entry, while denials are reviewed claims that fail payer approval.

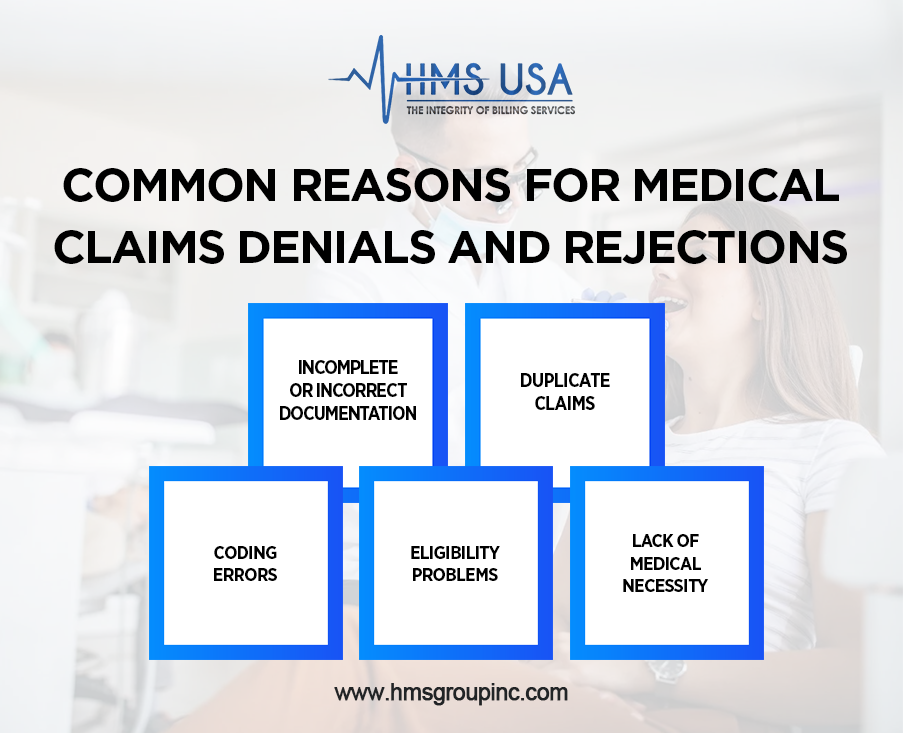

Common Reasons for Medical Claims Denials and Rejections

Medical claim errors can happen at different stages of the billing process. Knowing what causes these mistakes helps healthcare providers fix issues early and avoid payment delays.

1. Coding Errors

Using outdated or incorrect ICD-10 or CPT codes can trigger claim rejection or denial. Regularly update your code list and cross-check for accuracy.

2. Incomplete or Incorrect Documentation

Missing provider signatures, service notes, or required attachments can delay or deny claims. Always ensure documentation aligns with payer requirements.

3. Eligibility Problems

Submitting claims for inactive coverage or incorrect plan details often causes instant rejections. Always verify patient eligibility before submission.

4. Duplicate Claims

Resubmitting an already processed claim causes automatic rejections. Track claim statuses carefully to prevent duplication.

5. Lack of Medical Necessity

Payers deny claims if documentation doesn’t justify the service. Clear records and supporting evidence ensure coverage approval.

How to Prevent Claim Denials and Rejections

- Verify Patient & Insurance Details: Double-check patient demographics and coverage details.

- Use Updated Codes: Stay current with annual ICD-10 and CPT updates.

- Pre-screen Claims: Use claim scrubbing tools to catch errors before submission.

- Train Billing Staff: Keep your team updated on payer policies and coding guidelines.

Taking these preventive measures leads to higher clean claim rates and faster reimbursements.

The Role of Denial Management in Medical Billing

Denial management is a critical part of maintaining a healthy revenue cycle. Tracking and analysing denial codes in medical billing (like CO-50, CO-29, and CO-97) helps identify frequent issues and correct them before they impact cash flow.

By addressing recurring denial trends, healthcare providers can minimise losses, strengthen compliance, and speed up payment recovery.

Partnering with Professionals for Smooth Claims Management

Outsourcing your billing process to experienced professionals, such as Medical Billing Denial Management Services like HMS USA Inc., ensures fewer errors, faster reimbursements, and complete compliance. Our billing specialists handle everything from claim scrubbing to appeals, so you can focus on patient care while we manage your financial performance.

Wrap-Up

Understanding the difference between claim denial vs claim rejection helps healthcare providers fix issues faster and improve cash flow. Rejections are quick fixes, while denials require thorough review and appeal.

By using accurate coding, maintaining proper documentation, and partnering with a trusted billing team like HMS USA Inc., you can eliminate claim bottlenecks and ensure steady, timely reimbursements.

Contact HMS Group Inc. today to make your billing process more straightforward and keep your cash flow steady.

FAQs

Is claim denial the same as claim rejection?

No. Claim rejections happen before payer review due to technical errors, while claim denials occur after review when payment is refused.

Can a denied claim be resubmitted?

Yes. Denied claims can be appealed or corrected with additional documentation and then resubmitted.

What are common denial codes in medical billing?

Frequent denial codes include CO-50 (non-covered service), CO-29 (timely filing expired), and CO-97 (bundled payment).

How can practices reduce claim rejections?

By verifying patient data, using updated codes, and employing claim scrubbing tools before submission.

How can providers minimise medical claim denials?

Ensure proper documentation, obtain prior authorisations, and regularly monitor denial trends through effective denial management.