Healthcare practices need to be able to manage their revenue effectively to flourish in the long run. Claim denials are one of the biggest problems in this process because they can mess up the income cycle. Taking care of these denials isn’t just a way to cut down on mistakes; it’s also a smart way to improve cash flow, streamline processes, and make sure that insurers pay on time.

In this blog, we’ll explore the top 10 tips for reducing claim denials and helping your practice maintain a healthier bottom line.

What is Claim Denial in Medical Billing?

A claim denial in medical billing refers to a situation where a submitted healthcare claim is rejected by a payer, typically an insurance company, due to errors, omissions, or inconsistencies.

Refusing health insurance claims makes it tougher for doctors to make revenue and keep track of their paperwork. It costs both time and funds to handle rejected claims, which delays income and increases AR days.

There may be a loss of wealth and success if claims can’t be paid back. If you keep getting turned down, it could mean that there are issues with the payment process that need to be fixed.

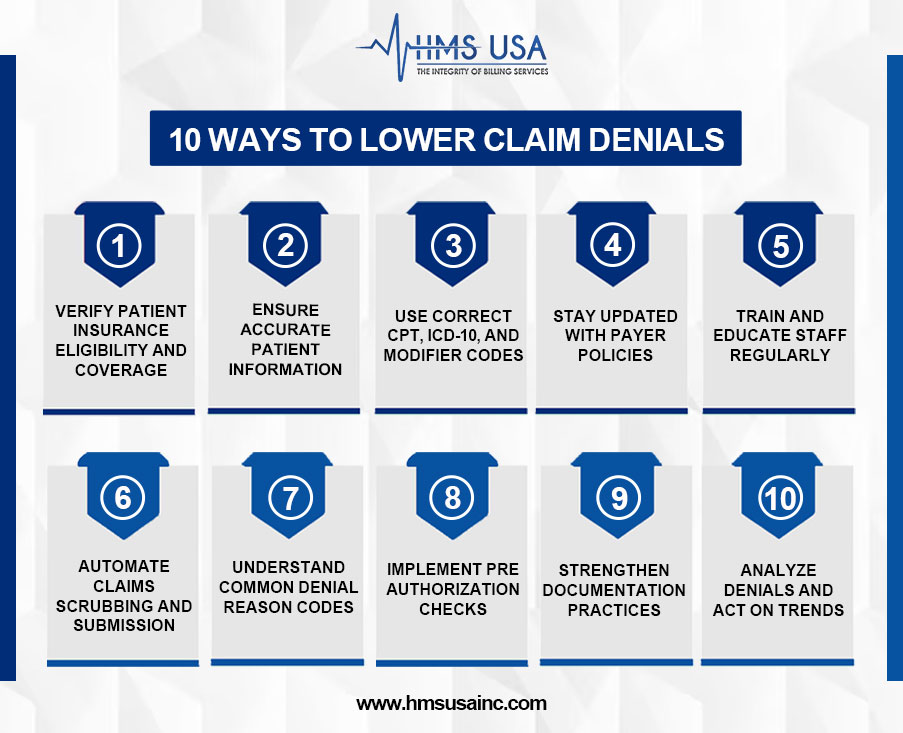

Below are the Top 10 ways to lower Claim Denials:

1. Verify Patient Insurance Eligibility and Coverage

Real-time insurance verification makes sure that the patient has coverage and that the services are paid for. It helps to be clear about pre-authorization needs, limits, and co-payment duties from the start, which cuts down on denials and gives accurate cost predictions.

2. Ensure Accurate Patient Information

When it comes to successfully submitting a claim, having accurate demographic and insurance data is necessary. Errors such as poorly spelled names or information that is no longer current can result in denials. The use of electronic verification tools, in conjunction with the verification of patient information during registration and visits, helps to reduce the number of errors that occur and enhances the processing of claims.

3. Use Correct CPT, ICD-10, and Modifier Codes

Accurate medical coding is essential for successful claims processing. Claims must include correct CPT codes, ICD-10 codes, and modifiers to ensure reimbursement. Incorrect or mismatched codes, such as outdated ICD-10 codes or missing modifiers, lead to claim denials (e.g., CO-11 or CO-4), delaying reimbursement and increasing administrative costs. Regular coding audits and staff training are vital for accuracy.

4. Stay Updated with Payer Policies

Insurance policies and rules for payers change all the time. Denials like CO-197 or CO-204 can happen if you don’t keep up with the latest information. To lower the risk of denials, providers should keep up with changes to policies, stay in touch with payers, and add real-time payment rules to their billing systems.

5. Train and Educate Staff Regularly

Regular training for billing, coding, and administrative staff is crucial to minimizing errors and reducing claim denials. As healthcare regulations and payer guidelines frequently change, ongoing education ensures staff stays updated on best practices and new requirements. This helps them identify issues early, improve accuracy, and promote long-term operational efficiency.

6. Automate Claims Scrubbing and Submission

By automating claims cleansing and submission, the human mistake is reduced and accuracy is guaranteed. Automatically looking for mistakes and inconsistencies, claims scrubbing technologies make sure claims satisfy payer criteria. This increases clean claim rates, shortens refund periods, and lowers administrative expenses, therefore improving general financial performance.

7. Understand Common Denial Reason Codes

For successful denial management and revenue cycle optimization, you need to know the most common denial reason codes in medical billing. When a payer rejects or denies a claim, they send these codes. These codes explain why reimbursement was refused and how to fix the problem.

Some frequently encountered denial codes for medical billing include:

CO-29: The time limit for filing has expired.

CO-16: Claim/service lacks information or has submission/billing errors.

CO-50: Non-covered services not deemed medically necessary.

CO-97: The benefit for this service is included in the payment/allowance for another service/procedure.

8. Implement Preauthorization Checks

Preauthorization ensures medical services are approved before provided. Insurance carriers require approval for high-cost procedures, imaging, and specialty treatments. Failing to obtain approval can lead to denials and delays. A structured pre authorization workflow can verify payer requirements early and prevent avoidable denials, improving efficiency and timely revenue generation.

9. Strengthen Documentation Practices

For medical necessity and claims processing, it is very important to have accurate clinical paperwork. Not having enough paperwork can cause problems like delays, rejections, and compliance risks. Providers should clearly write down what’s wrong with patients, why they’re getting care, and the results of their tests. Regular audits and following the rules for paperwork can cut down on denials and make sure claims are correct.

10. Analyze Denials and Act on Trends

Monitoring denial patterns helps identify common causes such as missing information, incorrect coding, or lack of authorization. Categorizing denials by type and payer allows for targeted corrective actions. Addressing root causes through process improvement, training, or system upgrades can prevent recurring issues and reduce future denials.

Final Words

Reducing claim denials isn’t just about fixing errors, it’s about preventing them. A flawless billing procedure depends on proactive efforts including proper documentation, insurance verification, and clever use of technology.

HMS treats denial management as a vital part of your revenue cycle. Our expert team helps you maximize reimbursements, minimize administrative stress, and strengthen your financial health.

Ready to take control of your revenue cycle? Contact HMS Group Inc. for customized denial and rejection claims in medical billing management and claim analysis solutions tailored to your practice.