Submitting accurate claims is one of the most critical parts of home healthcare. When claims are processed without issues, providers receive timely payments, and patients can continue their care uninterrupted. But claim denials are becoming more common. Today, approximately 11–15% of all healthcare claims are denied, and for services such as home health, initial denials can be as high as 17–21%.

The financial impact is enormous. Out of nearly $3 trillion in claims submitted every year, about $262 billion are initially denied. For an average provider, this can result in a loss of nearly $5 million annually. Even when half of these denials are overturned after appeal, providers still face delays in payments, extra paperwork, and wasted time.

For patients, denials often mean delays in getting the care they need. For billing companies, this means more rework and higher costs. That’s why addressing the root causes of health insurance claim denials is crucial for maintaining the smooth operation of home healthcare.

Common Reasons for Home Health Claim Denials

Home health claim denials can occur for various reasons, often due to errors, missing details, or non-compliance with payer rules and regulations. Understanding these causes helps providers take proactive steps to prevent revenue loss.

1. Incomplete or Inaccurate Documentation

Missing details in patient records, unclear physician notes, or incomplete care plans are among the most common reasons for claim denials. Even valid claims can be rejected without proper documentation.

2. Errors in Coding and Billing

Using outdated codes, selecting incorrect procedure codes, or mismatching diagnosis and treatment information can easily result in denials. Accurate coding is crucial for demonstrating medical necessity.

3. Lack of Itemized Statements

Without a detailed breakdown of services and costs, insurers may deny claims due to a lack of transparency. An itemized statement in medical billing strengthens payer trust and ensures compliance.

4. Eligibility and Coverage Issues

Claims are rejected if the services are not covered under a patient’s plan, prior authorization is not obtained, or eligibility is not verified before the service is rendered.

5. Late Claim Submission

Payers enforce strict deadlines. Submitting claims after the allowed period results in automatic denials, regardless of service validity.

6. Lack of Medical Necessity

If documentation doesn’t clearly justify why treatment or visit frequency was required, payers may conclude services were unnecessary.

7. Missing or Expired Prior Authorization

Some services need pre-approval. Failing to obtain or update authorization before care begins often leads to denial.

8. Duplicate Claims and Patient Information Errors

Claims are often denied when the same service is billed more than once, even if it is billed by mistake. Denials can also happen due to minor errors in patient details, such as a misspelled name, an incorrect insurance ID, or mismatched demographic information.

9. Noncompliance with Payer Guidelines

Every insurer has specific billing rules. Missing attachments, incorrect claim forms, or improper use of modifiers often result in immediate denials.

10. Documentation and Authorization Problems

Sometimes claims are denied because the paperwork doesn’t fully back up the services billed. Denials can also happen if a referral or prior authorization has expired before treatment. Additionally, mistakes such as billing separately for services that should be bundled (unbundling) or using higher-level codes than necessary (upcoding) can result in rejections and even audits by insurers.

11. Coordination and Technical Errors

Claim denials often occur due to coordination of benefits (COB) issues, especially when patients have multiple insurers and the primary payer is not billed first. Additionally, technical problems such as claim form mismatches, transmission failures, or outdated billing software can lead to preventable denials.

12. Provider and Service Limit Issues

Claims can be denied if the provider isn’t properly credentialed or enrolled with the insurer’s network. Denials also occur when services exceed the frequency limits set by insurance plans, such as the allowed number of visits or treatments per year.

The Financial and Operational Impact of Health Insurance Claim Denials

Claim denials can pose significant challenges for home healthcare providers. When claims are rejected, it slows down cash flow, reduces income, and in some cases, the money may never be recovered if appeals don’t succeed.

Denials also create extra work for staff, who must spend time fixing errors and resubmitting claims. This not only delays payments but can also affect patient care. To address these challenges, many providers opt to collaborate with professional home healthcare billing companies that specialize in denial prevention and revenue recovery.

If your team is struggling with rejections, partnering with HMS USA, a home healthcare billing company, can help cut errors, improve reimbursements, and reduce claim backlogs.

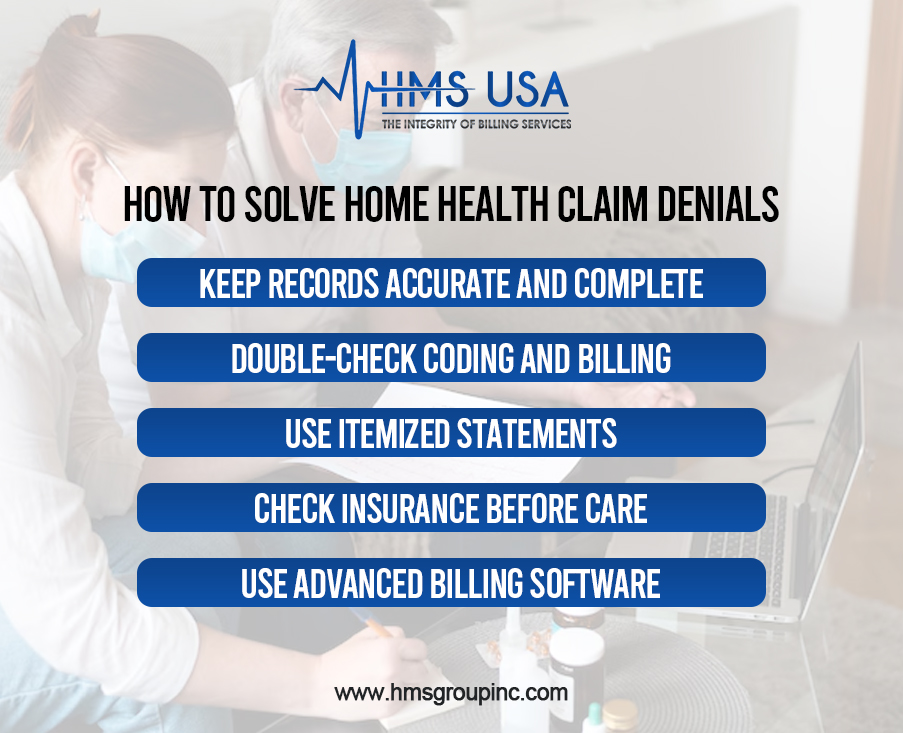

How to Solve Home Health Claim Denials

Keep Records Accurate and Complete

Precise and up-to-date patient records are the foundation of successful claims. They must include diagnoses, treatments, and outcomes.

Double-Check Coding and Billing

Most denials occur due to coding errors. Regular staff training and audits can help catch mistakes early.

Use itemized statements

Breaking down services and charges into a detailed list helps avoid confusion and speeds up the approval process.

Check insurance before care.

Verifying patient eligibility in advance prevents denials caused by inactive coverage or benefit limits.

Use Advanced billing software.

Technology can automatically identify errors, flag missing details, and streamline the entire process.

Best Practices for Preventing Denials

- Regularly train staff to stay updated on payer rules and coding changes.

- Conduct internal audits to identify and correct errors before submitting claims.

- Partner with professional billing companies for expert assistance and reduced errors.

- Implement denial management by tracking denial patterns and addressing their root causes.

Wrap-Up!

Home health claim denials often happen because of missing paperwork, coding errors, or late submissions. These problems can result in financial losses for providers, delay care, and cause stress.

The good news is that most denials can be avoided. Accurate records, correct coding, regular training, and itemized billing all contribute to reducing errors. Many providers also benefit from partnering with billing experts who bring the right tools and experience to streamline the process.

Are claim denials affecting your revenue and patient care? Don’t wait until small mistakes turn into bigger problems.

Contact HMS Group Inc. today. Our team can help you reduce denials, improve reimbursements, and simplify your home healthcare billing.

FAQs

What is the main reason home health claims get denied?

The most common reason is the presence of missing or incorrect information in the paperwork. For example, if the medical notes are incomplete or an itemized statement in medical billing is not provided, insurance companies may reject the claim.

How do health insurance claim denials affect providers?

When claims are denied, providers lose money and spend extra time fixing mistakes. This also slows down patient care. Many providers work with home healthcare billing companies to avoid these problems.

Can an itemized statement in medical billing help reduce denials?

Yes. An itemized statement clearly lists each service, making it easier for insurance companies to understand the charges. This reduces confusion and lowers the risk of denials in medical billing.

What can providers do to prevent home health claim denials?

Providers can verify a patient’s insurance coverage before providing care, maintain complete and accurate records, use the correct billing codes, and regularly train their staff. Working with experts in home healthcare billing also helps.

How do home healthcare billing companies help with denials?

These companies closely track claims, correct errors, and follow up with insurance companies. Their support helps providers get paid faster and reduces the number of denied claims.