The Ultimate Guide to Understanding Dental Insurance Billing

For a dental practice owner, understanding dental insurance billing is of paramount importance. Not only is learning insurance billing vital for patient satisfaction but it also helps dental practices to ensure that they get paid for the services rendered.

However, dental insurance billing is not a simple code to crack. Successful dental practices realize the importance of understanding dental insurance billing and how it is not one man’s job and requires a dedicated team who has substantial knowledge of dental billing.

Knowing how crucial it is to learn dental insurance billing for your practice’s success, you might want to know more about it. Good for you, because this is exactly what we will be discussing regarding legal dental insurance billing.

What is Dental Billing?

Dental billing is the process that involves submitting claims for dental services rendered by the practice and following up on them for reimbursement. This process is not as easy as it may seem. It requires preparing and submitting claims to either the patient themselves, the insurance company, or the government programs.

Once claims are submit they are tracked until billed. However, in case a claim is denied or rejected, it should be evaluated for any errors in the billing process. The claim is then resubmitted to the insurance company.

The process of dental billing and coding is quite complex. Dental practice requires an in-depth understanding of the insurance policies, billing regulations, and government programs to ensure the optimization of revenue.

Therefore dental practice often hires either an in-house team to manage its revenue cycle or outsource its dental earnings to billing companies that employ experts in the field to handle its revenue.

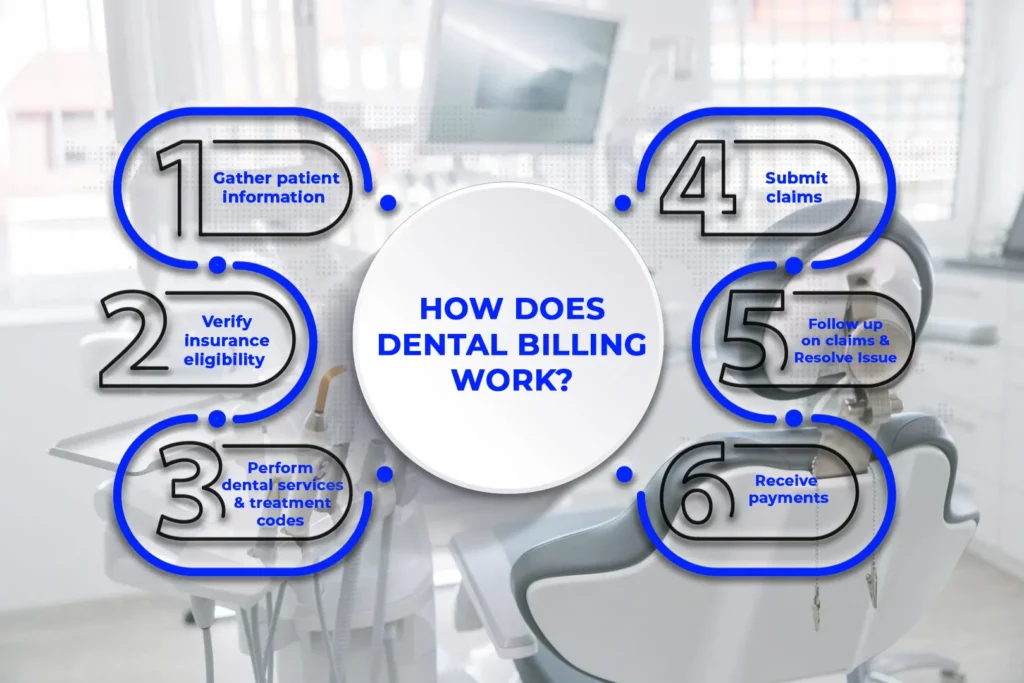

How Does Dental Billing Work?

Dental practice owners should have a basic understanding of the billing process to ensure smooth dental billing, even if they outsource their dental billing.

The dental billing cycle comprises multiple steps, which can be learn through this simple step-by-step guide:

Step 1: Gather Patient Information

The initial step in the dental billing cycle involves collecting relevant patient information which typically occurs when the patient calls to schedule a dental appointment. Being a dental practice you will collect the patient information which includes the name of the patient, their contact number, residential address, email address, insurance plan, insurance id number, and other pertinent details necessary for the billing process.

Step 2: Verify Insurance Eligibility

After obtaining the patient’s insurance details, it is crucial to verify their eligibility for the insurance benefits. This can be done by either directly getting in touch with the insurance company or by contacting them via an electronic verification system.

Verifying insurance eligibility helps the practice to avoid denied claims and mitigates the number of claims rejected.

Step 3: Perform Dental Services and Document Treatment Codes

Once the patient’s insurance eligibility is verified the dental practice can provide the necessary services during the appointment. The procedures performed on the patient are recorded in their chart with the treatment code, the date of the procedure, and its fee. This information is transferred to the billing software of the practice or the third party and then to the patient’s insurance company for reimbursement.

This step is crucial since accurate documentation ensures that the practice is paid promptly and accurately for the services rendered.

Step 4: Submit Claims

After providing dental services, dental practices submit claims to the insurance service provider for reimbursement. The claims can be submit either through conventional mail or electronically.

The insurance companies then review and process the claims. Dental practices should track the status of the claim to ensure timely payments.

Step 5: Follow up on Claims and Resolve Issues With Outstanding Claims

After submitting claims, the dental practice needs to monitor the claim to ensure that they have been processed. While most insurance companies pay claims within 30 to 45 days there can be instances where a claim is denied or not processed within the expected time frame. In such cases, the dental practice should follow up on the claim and insurance aging report.

This is a key step in the dental billing process. This requires the expertise of the dental billers to identify and resolve issues that may have affected the claim. Timely follow-up is essential to ensure that the practice receives reimbursements for the services provided.

Step 6: Receive payments

After the insurance company has processed the claims, the dental practice will receive payment for the service provided. It is necessary to verify that the payment received is accurate and matches the fee of the procedures performed.

This can be done by cross-checking the amount received with the treatment code used during claim submission. In case there are any discrepancies the billing team should take the necessary steps to sort out the issue with the insurance company.

What is The Importance of Dental Billing?

In the U.S. 65% of the dental practices work with dental insurance and 50.2% of the U.S. population avails dental insurance. This proves that dental insurance billing is an integral component in the management of the revenue cycle of dental practice.

Dental insurance billing is important for the following reasons:

Offers Reimbursement

Efficient dental insurance billing is integral for receiving reimbursements for the dental services offered to patients. It is necessary to have a streamlined billing and coding process for efficient cash flow. This ensures the financial stability of the practice and helps it to thrive.

Helps With Record Keeping

Due to the dental billing process, the entire patient record is managed in an organized manner. By accurately recording and processing insurance claims, dental practices can ensure that they receive timely reimbursement. This not only improves cash flow but also helps in tracking the financial progress of the practice.

Reduces Denied Claims

Accurate dental insurance billing can greatly help dental practices reduce their claims from getting denied. However, to achieve this, the dental practice should comply with the latest regulations of the insurance companies and government policies regarding dental billing. By adhering to these regulations dental practices can ensure they are billing correctly. Ultimately, thus mitigating the risk of legal consequences.

Results in Patient Satisfaction

Dental practices that offer transparency in their billing services gain the trust of their patients. This level of transparency builds trust between the patient and dental practice. Moreover, it also results in a positive patient experience. Ultimately, patient satisfaction can lead to increased loyalty and referrals, benefiting the practice in the end.

How to Learn Insurance Dental Billing?

The process of dental billing can be intricate. It requires a thorough understanding of the insurance billing process to ensure a streamlined revenue cycle for dental practice owners. It is important to know that mastering dental billing is not a quick process as it involves a high degree of complexity and requires precise attention to detail.

While it may sound tempting to quickly learn the process of insurance billing, practices should take time to thoroughly understand the entire framework of dental billing.

There are several effective ways for dental practice owners to learn insurance dental billing. Some of them are as follows:

Attend Training Workshops

There are training workshops that holistically cover dental insurance billing. They provide comprehensive knowledge and practical experience in dental billing. The design of these workshops are in a way to equip participants with the necessary expertise required for navigating complexities in the dental billing process.

Take Online Courses

Online courses are a great way to learn dental billing if someone wants a flexible option. Some online courses are free while others have a fee. By enrolling in one of these courses participants can learn dental insurance billing simply from the comfort of their home.

Read Publications on Dental Billing

Staying updated with the latest regulations and trends in the industry is extremely crucial for maintaining the financial stability of one’s dental practice. Therefore, it is necessary to read the latest publications to stay abreast of the latest changes in dental billing to help dental professionals make informed decisions for their practice.

Hire a Dental Billing Specialist

Alternatively, if dental billing seems too challenging and time-consuming then hiring a dental billing expert is an option worth considering. These billing experts take charge of the practice’s revenue cycle ensuring smooth submission of claims and improved cash flow. Additionally, hiring billing experts allows the practice to provide quality patient care.

Medical Billing for Dental Offices

Some dental practices offer medical billing services in addition to dental insurance billing. Medical billing is the process of submitting claims to medical insurance companies for reimbursement of medical services.

The consideration of medical billing is more complex and challenging as compare to dental billing primarily because medical insurance companies follow a different set of rules and regulations.

However, there are certain benefits of offering medical billing services in dental offices. They are as follows:

Increased Revenue

By offering medical billing services dental practice can improve the revenue cycle by generating more streams of earnings.

Enhanced Practice Efficiency

When a practice handles both medical and dental billing in-house it develops efficiency in operations.

Improved Patient Care

When practice integrates both medical and dental billing then patient care improves significantly. This approach offers comprehensive and personalized care to patients addressing both their dental and medical needs. Practice owners can provide a more holistic approach to patient care by prioritizing coordination between both fields.

Competitive Advantage

Offering medical billing services along with dental services gives practices a competitive advantage over other practices that only offer dental services. By providing medical and dental billing services, practices allow patients to receive both types of care at one stop.

This approach is particularly beneficial for patients who require both medical and dental care as it eliminates the need for them to seek care at various locations.

Ultimately, it helps the practice to make its mark in a competitive market by providing a more comprehensive and convenient option to patients.

Conclusion

Consequently, understanding dental insurance billing is vital for every dental practice owner. There is no denying that dental billing is a complex task. Handling dental billing requires a high level of expertise, nevertheless, it can be learn using the right resources.

If practices want to stay on top of business then they should learn dental insurance billing and integrate medical billing services to offer themselves an edge over others.

FAQs

Dental billing is a complicated field and learning it can be challenging too. However, when equipped with the right resources and the devotion to learn one can understand how dental billing works.

A dental healthcare provider should focus on the reason for the claim being denied and resubmit it with corrections if necessary and appeal the decision if the need arises.

CPT code D2740 is used to record the procedure of porcelain or ceramic dental crowns.

For anesthesia in the dental office, CPT code 00170 is used.

D7240 is the CPT code used to document the removal of the impacted wisdom tooth which is completely bony, whereas, the CPT code used for the documentation of impacted wisdom tooth which is partially bony is D7230.