Understanding what is contractual adjustment in medical billing is vital for every healthcare organization striving to maintain financial accuracy and compliance.

In medical billing, a contractual adjustment represents the difference between a provider’s billed charges and the allowed amount defined by the insurance company’s contract. Recognizing and applying these adjustments correctly helps avoid overbilling, ensures accurate financial reporting, and supports a healthy revenue cycle.

At HMS USA INC, we help healthcare providers manage insurance contractual adjustments efficiently, minimize claim denials, and maintain a clean accounts receivable process, so you can focus on patient care while we handle the complexities of billing.

What is Contractual Adjustment in Medical Billing?

A contractual adjustment occurs when a healthcare provider agrees, through a payer contract, not to charge patients the difference between the billed amount and the allowed payment determined by their insurance plan.

In simple terms, this adjustment ensures the provider complies with payer agreements and prevents charging patients more than the negotiated rate.

For example:

If a provider bills $500 for a service and the insurer’s allowed amount is $350, the remaining $150 becomes a contractual adjustment, not billable to the patient.

Key Point: A contractual adjustment is not the same as a write-off due to billing errors or unpaid balances. Contractual write-offs are pre-determined by the payer agreement, whereas non-contractual write-offs occur due to billing or collection issues.

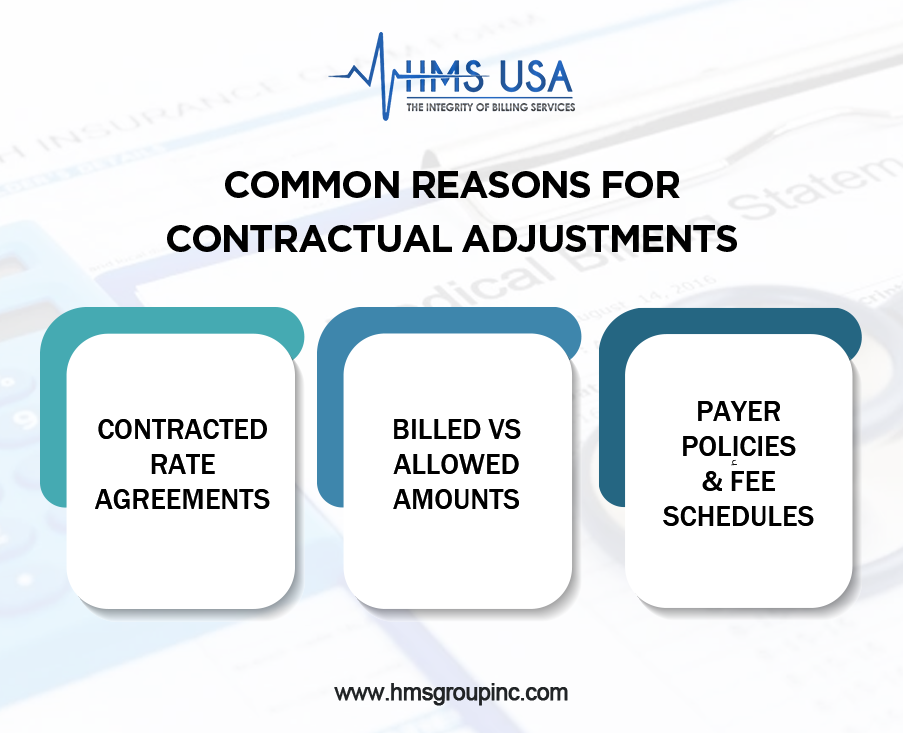

Common Reasons for Contractual Adjustments

Understanding the reasons behind contractual adjustments helps billing teams ensure accurate claim posting and compliance.

- Contracted Rate Agreements:

Providers must follow the fee schedules negotiated with insurance payers. Any charge above the contracted rate becomes a contractual adjustment. - Billed vs. Allowed Amounts:

When an insurer only pays up to the allowed amount, the excess balance is adjusted off. - Payer Policies and Fee Schedules:

Updates in payer fee schedules, coverage rules, or state regulations can lead to necessary adjustments.

Proper handling of these adjustments prevents compliance risks, reduces claim denials, and keeps financial reporting transparent.

Types of Contractual Adjustments

In medical billing, contractual adjustments happen when there’s a difference between what a healthcare provider charges and what the insurance company agrees to pay.

Knowing the different types helps billing staff manage claims correctly and keep financial records clear.

- Insurance Contractual Adjustment

The most common type, this adjustment shows the difference between the billed amount and the insurance company’s allowed payment.

- Patient Responsibility Adjustment

Covers patient portions like copays, deductibles, or coinsurance. This ensures that billing accurately reflects what’s owed by each party.

- Provider Write-Offs

When a provider must remove an uncollectible or non-covered balance from a patient’s account. These are sometimes required under payer contracts.

- Denied or Non-Covered Services

If a claim is denied or a service isn’t covered, that portion is adjusted off to maintain accurate billing records.

Understanding these categories allows billing professionals to distinguish between contractual adjustments and non-contractual write-offs, ensuring compliance and financial stability.

Contractual Adjustment Codes and Their Importance

Adjustment codes communicate why there’s a difference between the billed and paid amount.

Common code sets include:

- CARC (Claim Adjustment Reason Codes): Indicate payment reduction reasons such as contractual obligations or coverage limits.

- RARC (Remittance Advice Remark Codes): Provide additional explanations supporting CARC adjustments.

Together, these codes ensure transparency between payers and providers, reduce miscommunication, and maintain billing accuracy.

Contractual Write-Offs vs. Non-Contractual Write-Offs

Contractual Write-Offs

It occurs when providers accept the payer’s allowed amount as full payment under a contractual agreement. The difference between the billed and allowed amount is written off, patients are not responsible for this portion.

Non-Contractual Write-Offs

Result from issues like claim errors, billing delays, or uncollectible patient balances. Unlike contractual write-offs, these reflect inefficiencies in billing or collection processes and can negatively impact cash flow.

In summary:

- Contractual write-offs = part of the agreement (normal).

- Non-contractual write-offs = avoidable losses (errors or inefficiencies).

Impact on Revenue and Accounts Receivable

Contractual adjustments are a natural part of the revenue cycle management (RCM) process, but incorrect postings can distort financial visibility.

Financial Impact:

- Excessive or inaccurate adjustments can reduce expected revenue and make payer contracts appear underperforming.

- Consistent review of adjustment trends helps identify issues like underpayments or payer noncompliance.

Tips to Protect Revenue:

- Reconcile billed vs. allowed amounts monthly.

- Audit payer reimbursements for discrepancies.

- Use advanced reporting tools to detect anomalies.

Struggling with underpayments or frequent adjustments?

Let HMS USA INC handle your billing complexities. Book a Free Consultation Today and simplify your reimbursement process.

How Contractual Adjustments Affect Revenue Cycle Management

Financial Impact

Contractual adjustments play a big role in determining how much a provider actually earns. Too many or incorrectly recorded adjustments can make reports look inaccurate and hide how well payer contracts are performing.

Tips to Prevent Revenue Loss

- Review insurance contracts regularly to confirm payment rates are correct.

- Perform audits to find and fix wrong adjustment codes.

- Use billing software that spots unusual adjustment patterns.

- Train staff to recognize the difference between contractual and non-contractual adjustments.

Why Accurate Reporting Matters

Keeping adjustment records clear and accurate helps with compliance, financial planning, and decision-making. Regularly comparing billed, adjusted, and paid amounts ensures a healthy revenue cycle and supports the financial stability of the practice.

Avoiding Errors in Contractual Adjustment Posting

Errors in posting contractual adjustments are common in medical billing and can affect how much a provider gets paid. These mistakes often occur due to:

1. Use Advanced Billing Software

Automated billing platforms help prevent manual entry mistakes by applying correct payer-specific rates and flagging inconsistencies.

2. Conduct Regular Audits

Auditing ensures adjustments align with payer contracts and are accurately reflected in financial reports.

3. Provide Continuous Staff Training

Billing professionals should stay updated on CARC and RARC codes, payer contracts, and compliance updates to minimize posting errors.

4. Maintain Clear Communication with Payers

Regular communication ensures alignment with current fee schedules and prevents misunderstandings regarding coverage limits or adjustment policies.

Why Accurate Reporting Matters

Accurate reporting of insurance contractual adjustments improves:

- Financial forecasting

- Payer performance analysis

- Regulatory compliance

Clear reporting also helps healthcare administrators track accounts receivable (A/R) trends and take proactive measures against revenue leakage.

Final Words

Understanding contractual adjustments in medical billing is key to maintaining transparency, compliance, and financial stability. These adjustments ensure providers charge correctly, insurance companies pay accurately, and patients are billed fairly.

At HMS USA INC, we help medical practices optimize their billing process through precise contractual adjustment management, proactive denial prevention, and compliance-focused RCM strategies.

FAQs

What is a contractual adjustment in medical billing?

It’s the difference between what the provider bills and what the insurer agrees to pay under their contract.

How is a contractual adjustment different from a write-off?

A contractual adjustment is planned and based on payer contracts, while non-contractual write-offs result from billing or collection issues.

What are the main types of contractual adjustments?

They include insurance contractual adjustments, patient responsibility adjustments, and provider write-offs.

Why are contractual adjustments important?

They ensure billing compliance, accurate financial reporting, and prevent overcharging patients.

Which codes are used for contractual adjustments?

CARC and RARC codes identify and explain why payments differ from billed amounts.