Medical billing can be tricky, with lots of rules and codes to follow. Even small mistakes in claims or payments can cost healthcare providers money. Two terms that often confuse people are reversal and recoupment.

Here’s a simple way to understand the difference between reversal and recoupment in medical billing: Suppose an insurance company pays a claim but later finds a problem. If they cancel that payment completely, it’s called a reversal. If they keep the payment but decide to take the money back from future claims, that’s a recoupment.

This matters more than you think. Research shows that nearly 80% of medical bills have errors, which can lead to delays, compliance problems, and lost revenue. Knowing the difference between reversal and recoupment helps billing teams and providers handle these situations correctly and keep their finances on track.

What is Recoupment in Medical Billing?

Recoupment in medical billing happens when an insurance company or government health program takes back money it previously overpaid to a healthcare provider. Instead of asking for the money directly, the payer usually deducts the extra amount from future payments.

Overpayments can happen for several reasons, such as:

- Duplicate payments: When the same claim is accidentally paid more than once.

- Coding mistakes: using the wrong CPT, ICD-10, or HCPCS codes, which can result in higher payments.

- Eligibility issues: Billing for a patient who was not covered at the time of service.

- Post-payment audits: When payers review past claims and find errors or rule violations.

For healthcare providers, knowing how recoupment works is essential. It helps them avoid sudden payment cuts and keep their finances on track.

What is Reversal in Medical Billing?

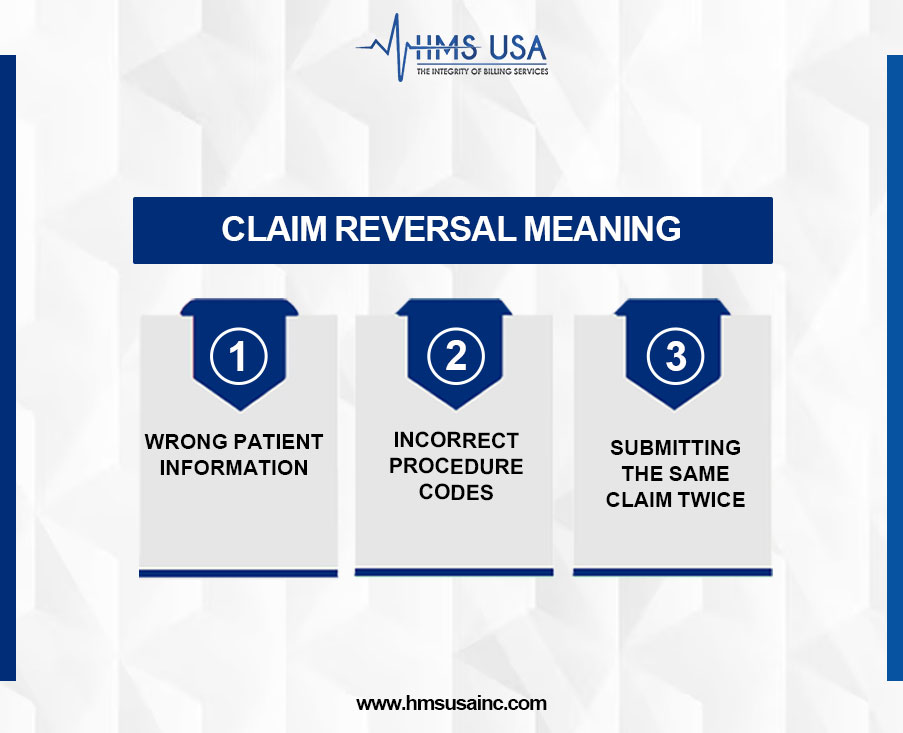

Definition of Reversal in Medical Billing – Claim Reversal Meaning

A reversal in medical billing means canceling a claim that was already sent to the insurance company. This usually happens when mistakes are found, such as:

- Wrong patient information

- Incorrect procedure codes

- Submitting the same claim twice

Reversals make sure incorrect claims don’t stay in the system, which helps avoid payment errors and record problems.

Claim Reversal Examples

If a provider submits the same claim twice, the insurance company may reverse one to stop double payment.

If a patient’s insurance details are entered incorrectly, the claim can be reversed and then sent again with the correct information.

Comparison of Reversal vs. Recoupment in Medical Billing

| Aspect | Reversal in Medical Billing | Recoupment in Medical Billing |

| Definition | Cancellation or adjustment of a claim after it has been processed, often due to errors. | It can occur weeks or months after the initial payment. |

| Also Known As | Claim reversal, health insurance claim reversal. | Overpayment recovery, claim adjustment. |

| Trigger | Billing error, incorrect patient info, duplicate submission, or coding mistakes. | Overpayment by insurer, eligibility issues, or retrospective review. |

| Financial Impact | The process by which payers recover funds from providers for overpaid claims. | Providers must return the overpaid amount, often deducted from future payments. |

| Timing | Happens shortly after claim submission or payment. | Repay or adjust future claims as per the payer’s notice. |

| Provider’s Role | The claim is nullified or corrected before/after payment is made. | The insurance company finds a duplicate payment and deducts it from the next reimbursement cycle. |

| Example | A claim submitted with the wrong patient ID is reversed and corrected. | The insurance company finds duplicate payment and deducts it from the next reimbursement cycle. |

Reversal vs. Denial

It’s essential to know the difference:

Reversal: The claim is canceled because of an error or a duplicate. The provider can fix it and send it again.

Denial: The claim was reviewed but rejected because it didn’t meet coverage or documentation rules. In this case, the provider must appeal or correct the issue.

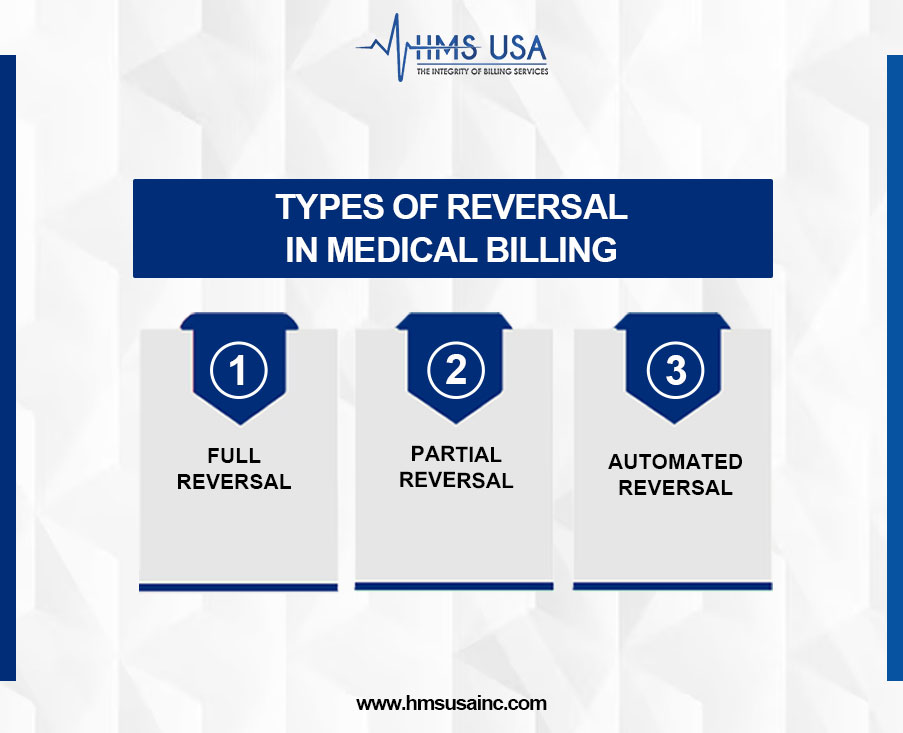

How many Types Of Reversal in Medical Billing?

- Complete Reversal: The entire claim is canceled.

- Partial Reversal: Only certain services or items are canceled, while the rest stay valid.

- Automated Reversal: The system cancels a claim automatically, usually for duplicates or processing errors.

Impact on Healthcare Providers and Patients

For providers, reversals usually mean extra paperwork but not a significant financial loss, since the claim can often be fixed and sent again. Recoupments are different; they take money back, which directly lowers a provider’s income. Patients may notice delays with reversals or receive updated bills with recoupments, which can be confusing.

Financial and Compliance Implications

Reversals slow down payments, while recoupments reduce revenue right away. Both show why accurate coding, documentation, and claim submission are so necessary. Too many errors can lead to audits and damage a provider’s relationship with insurance companies.

Common Reasons for Reversal and Recoupment

Reversals and recoupments usually happen when there’s a problem with a claim.

The most common reasons include:

- Billing Errors: Using the wrong code, sending the same claim twice, or entering the wrong patient details.

- Overpayments: Sometimes insurance companies pay more than they should and ask for the extra money back.

- Eligibility or Approval Issues: If a patient isn’t covered on the service date or if prior approval wasn’t given, the claim may be canceled or money taken back.

Knowing these causes can help providers avoid delays and lost revenue.

How Providers Can Manage Reversals and Recoupments

Providers can lower the risk of these issues by:

- Reducing Mistakes: Train staff well, use clear billing steps, and double-check claims before sending them.

- Keeping Good Records: Accurate notes and correct codes make claims stronger and less likely to be rejected.

- Using Billing Software and Audits: Technology can spot errors early, and regular audits catch problems before insurers do.

These steps make billing smoother and help protect providers’ income.

Wrapping-Up

Reversals and recoupments are not the same.

- A reversal cancels a claim before payment.

- A recoupment takes back money that was already paid.

Understanding both helps providers keep billing accurate and revenue steady.

Medical billing can be tricky, but you don’t have to handle it alone. HMS Group Inc. can help you manage claims, avoid costly mistakes, and keep your practice financially strong. Contact their team today for expert support.

FAQs

What is the difference between reversal and recoupment in medical billing?

A reversal cancels or fixes a claim with errors. Recoupment happens when the insurance company takes back money it overpaid to a provider.

What is recoupment in medical billing, with an example?

Recoupment means the insurer reclaims extra money it paid.

Example: If a doctor is paid twice for the same service, the insurer will subtract the extra payment from future claims.

What does claim reversal mean in medical billing?

Claim reversal means canceling or changing a claim that had mistakes, such as the wrong patient details, the wrong procedure code, or a duplicate submission.

How many types of reversals are there in medical billing?

The common types are:

- Complete reversal – the entire claim is canceled.

- Partial reversal – only part of the claim is canceled.

- Duplicate claim reversal – a repeated claim is removed.

How can providers avoid reversal and recoupment issues?

Providers can reduce problems by:

- Keeping patient and claiming information accurately.

- Using proper medical codes.

- Running regular billing audits to catch mistakes early.